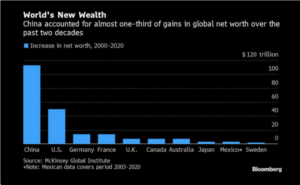

According to a new report from McKinsey & Co, global wealth has skyrocketed over the last twenty years — soaring from $156 trillion in the year 2000 to $514 trillion in 2020. “We are now wealthier than we have ever been,” said Jan Mischke, a partner at the McKinsey Global Institute in Zurich.

While the United States saw its wealth more than double to $90 trillion over the past two decades, China’s wealth soared from $7 trillion in 2000 to a staggering $120 trillion in 2020, surpassing the U.S. to become the richest nation on the planet. China alone accounted for nearly a third of the total increase in global net worth, according to the report.

Much of the world’s wealth is held in real estate, which has been fueled by low-interest rates and rocketing property prices. It is not, however, supported by a correlating increase in global GDP. According to McKinsey, asset prices are some 50% above their long-run average relative to income. This, of course, raises the question of sustainability and the notion of bubbles and busts.

China, in particular, runs the risk of a 2008-style financial crisis due to property developers like Evergrande, which is now strapped with more than $300 billion in debt due to feverish development and heavy borrowing. The Chinese real estate giant has been a model for other Chinese developers who have also engaged in excessive borrowing to fund dizzying housing demand, and all of them now face declining home sales and a growing credit crunch.

According to Investopedia, the collapse of the U.S. housing market during the Great Recession saw 10 million Americans displaced due to mass foreclosures, which at its height, was one in every 54 homes. The U.S. housing collapse sparked a global financial crisis, an economic downturn, and the deepest recession since World War II.

According to Business Insider, the Great Recession lasted 18 months and was among the worst economic crises in U.S. history.

The statistics are staggering:

- The net worth of U.S. households declined, erasing $19.2 trillion in wealth.

- Gross domestic product (GDP) fell 4.3%, the largest decline in 60 years.

- The unemployment rate reached 10% in October 2009 — rates were even higher among Black and Hispanic households at about 15% and 12%, respectively

- Home foreclosures skyrocketed, with nearly three million a year in 2009 and 2010

- The U.S. lost $7.4 trillion in stock wealth from July 2008 to March 2009

The McKinsey report maintains that a similar collapse in global asset prices could wipe out as much as 33% of the world’s wealth.

The McKinsey report maintains that a similar collapse in global asset prices could wipe out as much as 33% of the world’s wealth.

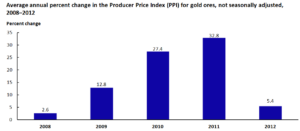

According to a 2013 report from the Bureau of Labor Statistics, the price of gold increased dramatically between 2008 and 2012. The report quoted Fed Chair Ben Bernanke as stating that gold prices can act as an indicator of the health of the economy. He suggested that a rise in the price of gold may be a signal that the “economy is struggling.” As a result, in times of either a crisis or inflation, many investors turn to gold to “protect their principal.”

The report also charts gold’s meteoric rise, “from September 2010 to September 2011, gold prices jumped 50.6 percent, due to speculation surrounding an uneven recovery and volatility in the U.S. financial markets, with gold reaching an all-time high of $1,917.90 an ounce in late August of 2011.”

Evergrande’s debt is coming due over the next six months, and default seems likely. The company’s demise has exposed the fragility of other Chinese developers as well, and much like 2008 — a debt-fueled downturn in the Chinese real estate sector would be a major shock to their broader financial system. Since the Chinese now hold the bulk of the world’s wealth, this would have disastrous implications globally. And, if history is any guide, investors would likely once again turn to gold to “protect their principal.”